Why Managed Payroll Services are a Strategic Investment! Not Just a Cost Saver

- Posted by Oscoworks

- On July 14, 2025

- 0 Comments

Managed payroll services go beyond simply cutting costs, they transform how businesses operate by streamlining processes, ensuring compliance and enhancing employee satisfaction. For companies in Thailand, where regulatory complexities and cultural nuances play a significant role, expert-led payroll outsourcing offers strategic advantages that drive long-term success. Here’s how:

- Ensuring full compliance with local laws

Navigating a labor regulations, Social Security Fund (SSF) contributions and tax policies requires in-depth local knowledge. Managed payroll services, led by experts familiar with local regulations that ensure your business stays compliant, reducing costly penalties and legal issues. - Time efficiency for core business focus

Payroll processing is time-intensive and detail-oriented. By outsourcing professionals, your HR and finance teams can focus on strategic initiatives like talent development and business growth rather than administrative tasks. - Improved accuracy and employee trust

Errors in payroll can undermine employee confidence and lead to dissatisfaction. Professional payroll providers utilize advanced technology and rigorous checks to ensure employees are paid correctly and on time, fostering trust among your workforces. - Scalability for growing businesses

Whether you’re a startup or a multinational, managed payroll services adapt to your needs. These services provide flexible solutions that scale with your workforce, from small teams to large enterprises. - Data security and confidentiality

Payroll involves sensitive employee data. Expert providers implement robust security measures to protect personal information, ensuring compliance with Thailand’s Personal Data Protection Act (PDPA) and reducing the risk of data breaches. - Strategic insights through analytics

Beyond processing payments, these services deliver detailed reports and analytics. These insights help businesses optimize HR budgets, track expenses and make informed decisions about raises, bonuses and workforce planning.

By partnering with expert payroll providers, businesses gain peace of mind, operational efficiency, and a competitive edge, making it a strategic investment far beyond cost savings.

What Is Managed Payroll?

Managed payroll, also known as payroll outsourcing, is the practice of delegating payroll-related tasks to a third-party provider with specialized expertise, handle the end-to-end process of payroll management, ensuring accuracy, compliance and efficiency. These services are particularly valuable for businesses navigating complex regulatory environment, which includes tax filings, Social Security contributions and labor law compliance.

Key Components of Managed Payroll:

- Salary calculations: Accurately computing gross and net salaries, including overtime, bonuses, and allowances.

- Tax compliance: Managing withholding tax deductions and filing monthly returns with the Revenue Department within 15 days of the following month.

- Social cecurity contributions: Calculating and submitting employer and employee contributions at 5% of salary, maximum capped at 750 baht per month to the Social Security Fund.

- Payslip generation: Providing detailed, compliant payslips for employees in Thai or English

- Statutory Reporting: Preparing and submitting required forms, such as Withholding Tax Certificates (BIS 50), to meet a regulatory standard.

- Employee data protection: Securely handling personal and financial data in line with PDPA requirements.

- Expert guidance: Stay ahead of labor law changes with our advisory services.

Managed payroll services are tailored to meet the needs of businesses of all sizes, from SMEs to multinational corporations, allowing you to focus on growth while experts handle the complexities of payroll.

A Step-by-Step Payroll Processing Checklist

Managing payroll in Thailand requires precision and adherence to local regulations. This step-by-step checklist ensures a seamless payroll process, whether handled in-house or outsourced to experts.

- Gather employee information

- Collect and verify employee details, including names, ID numbers, bank account details, and tax identification numbers.

- Update records for new hires, terminations or changes in salary or status.

- Calculate gross salaries

- Compute base salaries, overtime, bonuses, commissions, and allowances based on employment contracts and company policies.

- Ensure calculations align with Thailand’s minimum wage laws and industry standards.

- Determine deductions

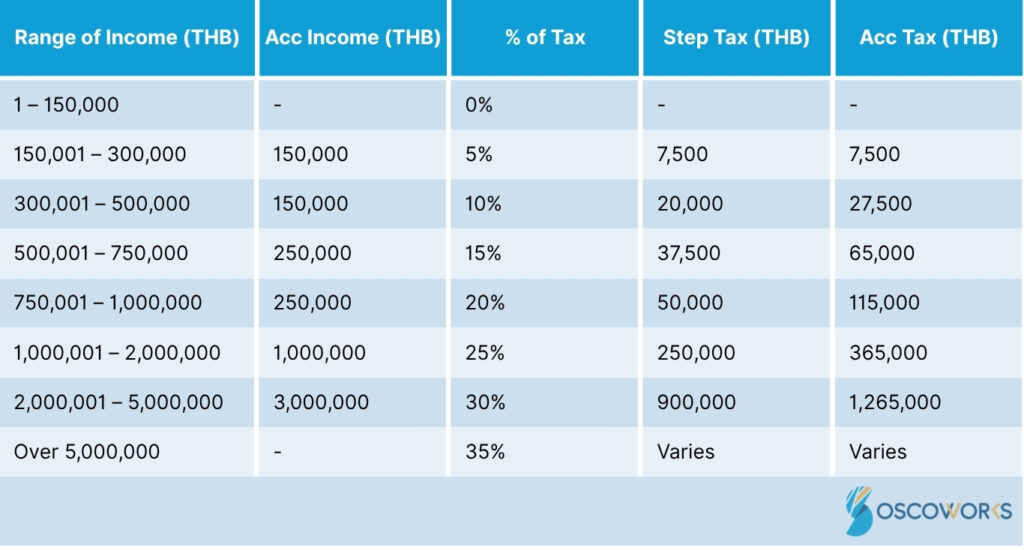

- Calculate withholding tax based on Thailand’s progressive income tax rates (0%–35%). See the tax rates table below

- Deduct Social Security contributions 750 baht per month for both employer and employee.

- Account for provident fund contributions or other benefits, if applicable.

- Generate payslips

- Create detailed payslips showing gross salary, deductions, and net pay.

- Ensure payslips are compliant with Thai regulations and available in Thai or English, as needed.

- Process payments

- Transfer net salaries to employee bank accounts via direct deposit or other agreed methods.

- Confirm payment deadlines to avoid delays, typically aligned with monthly payroll schedules.

- File statutory peports

- Submit withholding tax returns to the Revenue Department within seven days of the following month.

- File Social Security contributions with the Social Security Office by the 15th of the following month.

- Prepare and issue Withholding Tax Certificates (BIS 50) for annual tax filings.

- Maintain records and compliance

- Store payroll records securely for at least five years, as required by Thai law.

- Regularly audit payroll processes to ensure compliance with labor laws and PDPA.

- Review and approve

- Review payroll reports for accuracy before finalizing payments.

- Communicate with employees to address questions or discrepancies promptly.

- Stay updated on regulations

- Monitor changes in Thai labor laws, tax rates, or Social Security requirements.

- Consult with payroll experts to ensure ongoing compliance.

By following this checklist or partnering with payroll outsourcing, businesses can streamline your payroll process, reduce errors and maintain compliance with local regulations.

Small errors can create big problems, Learn to Avoid These 7 Common Payroll Mistakes.

Why Choose Outsource Payroll?

Managed payroll services offer tailored solutions that empower businesses of all sizes to thrive, ensuring seamless operations while mitigating risks. Here’s a closer look at the compelling reasons why a growing number of companies are choosing to outsource payroll.

Here’s why you should consider outsourcing:

- Local expertise provides with in-depth knowledge of local labor laws, tax regulations and cultural nuances ensure full compliance and smooth operations.

- Customized solutions; Services are tailored to your business needs that match your workforce size and complexity, from basic payroll processing to full compliance.

- Cost and time savings; Outsourcing eliminates the need for in-house payroll staff, software investments, and extensive training, freeing resources for growth.

- Employee satisfaction; Timely, accurate payments and transparent payslips boost employee morale and trust.

- Transparency; No surprises, no hidden costs you pay only for the solutions your business requires, ensuring cost efficiency without compromising quality.

- Dedicated expert support, your trusted payroll partner. You gain access to payroll specialists who are more than just service providers’ ongoing guidance and support guidance on complex labor laws.

In Thailand’s dynamic business environment, outsourcing payroll isn’t just about delegating a task; it’s about making a strategic decision that enhances efficiency, ensures compliance, optimizes costs and ultimately allows your business to focus on what it does best; growing and succeeding.

Let us handle the complexities of payroll so you can focus on growing your business!

Simplify payroll and stay compliant. Request a Free Consultation at info@oscoworks.com or Call/WhatsApp +66(0)841 659 264

Thailand’s Personal Income Tax Rates (2025)

The table below, based on your input, outlines progressive tax rates for residents (individuals staying in Thailand for 180 days or more per year). It shows the taxable income ranges, tax rates, step tax (tax for each bracket), and accumulated tax.

0 Comments