EOR Thailand vs. Payroll Services – Which option is best for growing your business in Thailand?

- Posted by Oscoworks

- On June 30, 2025

- 0 Comments

Thailand is increasingly recognized as a strategic hub for companies expanding into Southeast Asia.

For businesses looking to expand operation quickly and compliantly in Thailand, many organizations turn to Employer of Record (EOR) providers to ensure a seamless entry into the Thai market. These EOR Thailand services provide the local expertise and comprehensive resources needed to manage all aspects of the employment lifecycle.

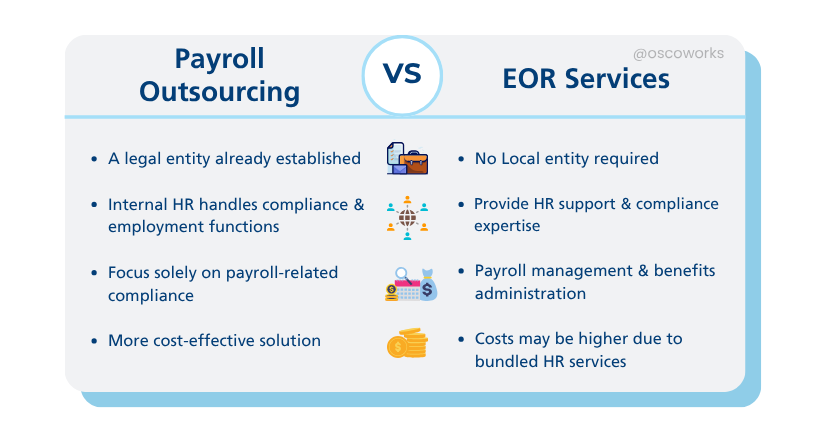

However, when considering outsourcing employment functions, businesses typically weigh their options between engaging an Employer of Record (EOR) provider or dedicated payroll service. While there is some overlap in offerings, each provides distinct advantages tailored to different business needs and strategic objectives. Understanding these differences is crucial for making informed decisions that aligns with your expansion goals.

What is Employer of Record (EOR) ?

EOR Thailand acts as the legal employer for your employees without the need to establish your own entity in Thailand, where you retain full operational control over their daily tasks and performance such as customer service, sales, marketing, employee tasks and assignments.

EOR solutions are popular alternative to setting up your entity overseas for businesses wishing to quickly hire local employees and expand into new markets like Thailand. They streamline the process, ensuring compliance with local labor laws and regulations from day one.

What EOR Thailand can handle on behalf of your organization

- Comprehensive HR Support:

- Onboarding & Offboarding: Managing contracts, new hire paperwork, and compliant termination processes.

- Benefits Administration: Ensuring employees receive statutory benefits (e.g., social security, leave entitlements) and often offering access to competitive supplementary benefits (e.g., health insurance, pensions) through their established networks.

- Employee Relations: Providing support for HR queries and general employee management issues, ensuring they are handled according to local labor laws.

- Payroll Management & Benefits:

- Accurate Payroll Processing: Calculating salaries, commissions, bonuses and expenses in the local currency.

- Tax Withholding & Remittance: Correctly deducting and remitting all required employee and employer taxes (e.g., income tax, social security contributions, unemployment benefits) to the relevant local authorities.

- Benefits Administration: As mentioned above, managing all mandatory and often optional benefits, including enrollment, administration and compliance with local regulations.

- Work Permits and Visas: For foreign employees, obtaining and maintaining work permits and visas is usually outside the scope of a standard payroll outsourcing service.

- Compliance Expertise:

- Local Compliance: Ensuring all aspects of employment (contracts, working hours, leave, termination, anti-discrimination and etc.) adhere to local statutes.

- Risk Mitigation: By becoming the legal employer, the EOR absorbs the legal and financial risks associated with non-compliance such as fines, penalties and legal disputes related to employment. This significantly protects your company.

- Up-to-date Knowledge: EORs continuously monitor changes in local employment laws and update their practices accordingly, ensuring your operations remain compliant in an ever-evolving legal landscape.

- Cost Implication: Usually higher due to the comprehensive employment management and legal liability assumption.

- Full Legal & HR Responsibility: You are paying for the transfer of legal employer status and all associated compliance risks.

- Comprehensive Service Package: The fee covers not just payroll but also extensive HR support, benefits administration and constant legal compliance monitoring.

- Local Expertise: You are leveraging the EOR’s deep, on-the-ground knowledge and infrastructure in the target country.

What is Payroll Outsourcing Services?

Payroll outsourcing focuses solely on payroll processing; tax management and related compliance matters and wants to keep other HR tasks in house. This involves the calculation and processing of employee salaries and related tax withholding, social security contributions to a third-party provider Payroll services are best suited for companies with an existing local entity or those hiring independent contractors. In this model, your company remains the legal employer, you’ll continue to make decisions for your employees like benefits and retain all responsibilities and liabilities for payroll taxes and certain HR compliance requirements usually stay with you, their employer.

How Payroll Outsourcing Services work

- Information Collection and Setup:

- Initial data gathering: The process begins with the payroll provider collecting all necessary employee and payroll data from the client company as us employee hours worked, salaries, wage rates, deductions and other relevant information.

- System Configuration: The payroll provider configures their system based on the client’s specific pay cycle (e.g., monthly, bi-weekly) and company policies, ensuring alignment with Thai regulations.

- Payroll Processing:

- Correct calculation salaries and withholding of personal income tax (PIT) and social security contributions.

- Other statutory seductions and sontributions: Provident fund contributions (if applicable) and workers’ compensation.

- Ensuring timely payments to employees and relevant government authorities.

- Handling statutory filings and year-end reporting in accordance with Thai tax and labor laws

- Generating payslips

- Reporting and Compliance: Generates payroll reports for the client company, including employee earnings summaries, tax summaries and providing required documentation for audits or government inquiries.

- Administrative Relief: It reduces the internal administrative burden of running payroll

- Cost Implication: Generally lower as it only involves payroll processing fees, typically flat monthly fee or a per-employee-per-month fee or a per-payroll fee is charged.

Choosing the Best Option for Your Business needs

Both Payroll Outsourcing and Employer of Record (EOR) services offer valuable solutions for managing international teams, but the right choice depends on your company’s structure, specific goals, operational needs and growth plans. Partnering with EOR gives you immediate access to knowledge of legal setup, Thai laws and regulations and overall level of legal protection, you can hire a team of employees seamlessly as an EOR is the smarter, safer route. If you already have a local entity and simply need help with payroll tasks, streamlining existing operations without adding overhead. A payroll provider could suffice.

At Oscoworks, we’re more than just a service provider, we’re a dedicated partner committed to your success. We go the extra mile to support your growth and help you thrive in Thailand’s dynamic market.

0 Comments